How to Avoid Holiday Shopping Scams and Protect Your Digital Wallet

Discover how scammers exploit the holiday shopping rush with fake websites and digital wallet fraud, and learn how to protect your online payments this season.

Discover how scammers exploit the holiday shopping rush with fake websites and digital wallet fraud, and learn how to protect your online payments this season.

Explore how impersonation scams are eroding customer trust in banking—and how AI-driven identity validation can stop fraud before it starts.

Explore which consumer groups are most targeted by financial scams, why they’re vulnerable, and how banks can implement tailored, proactive strategies to protect customers and strengthen trust.

Learn how financial institutions can transform the EU’s Verification of Payee regulation from a compliance mandate into a strategic advantage that builds customer trust and prevents payment fraud.

Explore how stronger payee identity verification and AI-driven detection help banks prevent authorized push payment fraud, protect customers, and strengthen trust across digital payment ecosystems.

Discover how scammers target call centers, the social engineering tactics they use, and how banks can secure customer support teams with training, processes, and AI-assisted monitoring.

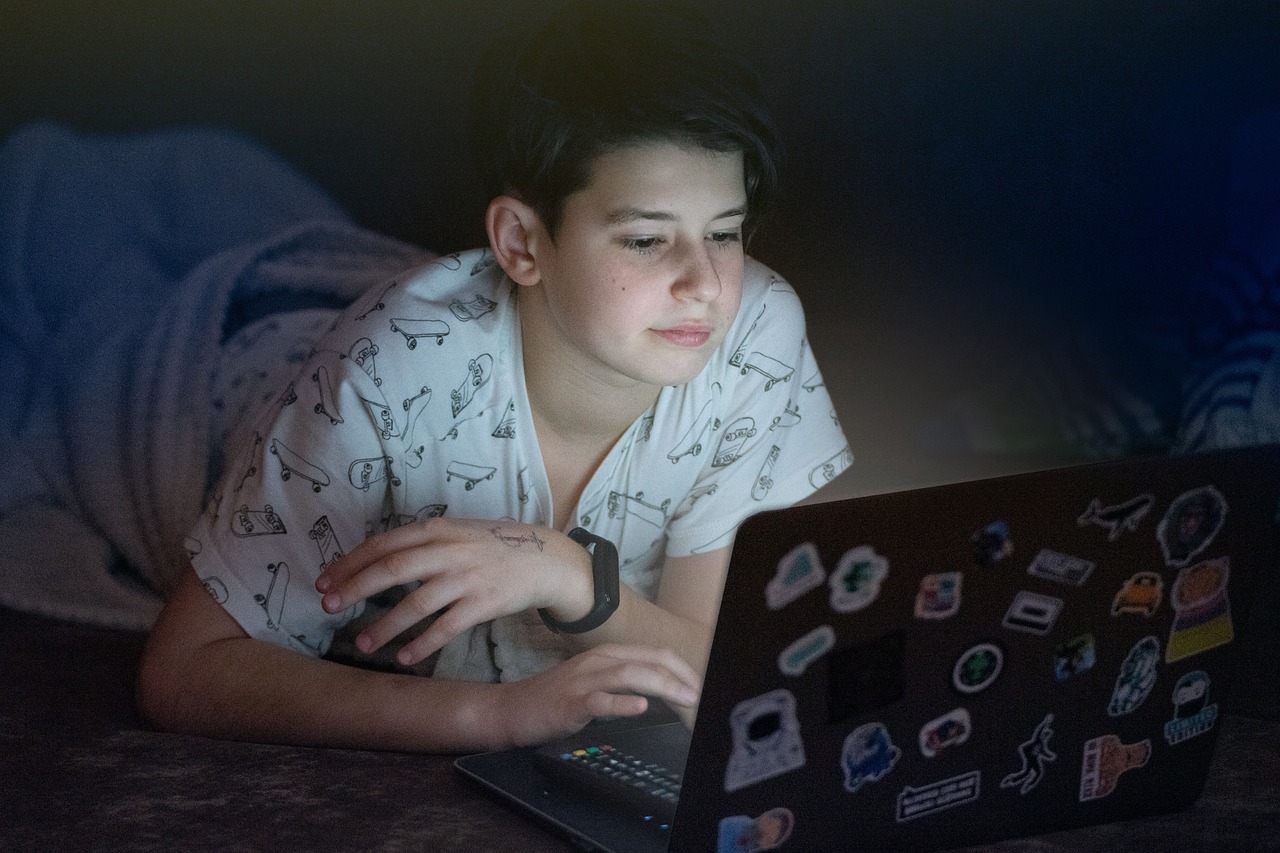

Sextortion thrives on anonymity. Digital identity verification cuts through deception by confirming who’s real online—helping protect individuals and institutions from manipulation and financial harm.

Many teens won’t tell their parents they’re being threatened online. Banks can bridge that gap by educating families and promoting tools that verify identities and prevent sextortion before it happens.

Sextortion scams are rising fast among teens, using fake identities and emotional manipulation to exploit victims. Learn how proactive identity verification helps stop these schemes before they start.

Financial fraud no longer stops at stolen credit cards. Banks now play a crucial role in protecting digital identities and preventing scams that begin with emotional manipulation and sextortion.

Scamnetic and Sigma Loyalty Group join forces to expand scam protection globally. This strategic licensing deal integrates AI-powered identity protection into Sigma’s platform, enhancing consumer safety across international markets.

Fraud detection has evolved, but the final step — engaging the customer — remains outdated. Manual workflows, false positives, and ineffective responses are costing businesses. It’s time to fix the

Stopping scams requires more than detection tools—financial institutions need a holistic approach combining technology, policy changes, customer education, and cross-industry collaboration to create a stronger, coordinated defense.

Scammers exploit insurance policies through fake claims and identity theft. Discover how insurers can detect fraud in real time and protect policyholders with smarter verification.

Scamnetic and Kasasa announce a partnership to deliver AI-powered scam protection for community banks and credit unions. By embedding Scamnetic’s KnowScam into Kasasa’s SureLock™, institutions can protect consumers from deepfake

Pig butchering scams exploit banking systems by masking transfers as legitimate. See how banks can detect mule networks and strengthen prevention with behavioral analytics and real-time identity verification.

Learn how insurers can prevent policyholder scams with targeted fraud detection, strong security practices, and education strategies that safeguard both customer trust and company reputation.

Traditional fraud filters miss human manipulation. Discover how AI scam detection is redefining fraud prevention across banking, insurance, and credit industries facing evolving social engineering tactics.

Account takeover fraud is evolving through social engineering and real-time manipulation. Discover how AI scam detection helps financial institutions protect customers before scammers gain control.

Scamnetic and Anonybit partner to deliver AI-powered threat detection and decentralized biometrics, helping financial institutions prevent scams and identity theft while protecting customers from onboarding to recovery.

Money mule networks fuel modern scams, yet traditional monitoring fails to stop them. Learn why identity-focused strategies and behavioral analytics are key to reducing fraud risk for financial institutions.

Static KYC checks leave banks exposed to synthetic identities and account takeovers. Discover why continuous, real-time identity verification is the future of scam prevention and customer trust.

Financial scams exploit stolen and synthetic identities, leaving banks vulnerable. Learn why identity verification—not account checks—must drive next-generation scam prevention strategies to protect customers and reduce institutional risk.

Confirmation of Payee creates confidence but not true protection. Discover why name-matching fails to stop scams and why banks must adopt identity-focused strategies to strengthen scam prevention and reduce fraud

Discover how scammers use urgent texts to pressure victims and practical steps to verify emergency messages, helping you avoid costly mistakes and protect your finances from fraud.

Urgency scams exploit fake emergencies to trigger panic and steal money. Discover how to recognize deceptive tactics and protect yourself from real financial losses.

Scamnetic has officially been selected to join the first cohort of the Mastercard Start Path Security Solutions program! Joining Mastercard Start Path represents a pivotal moment in Scamnetic’s journey —