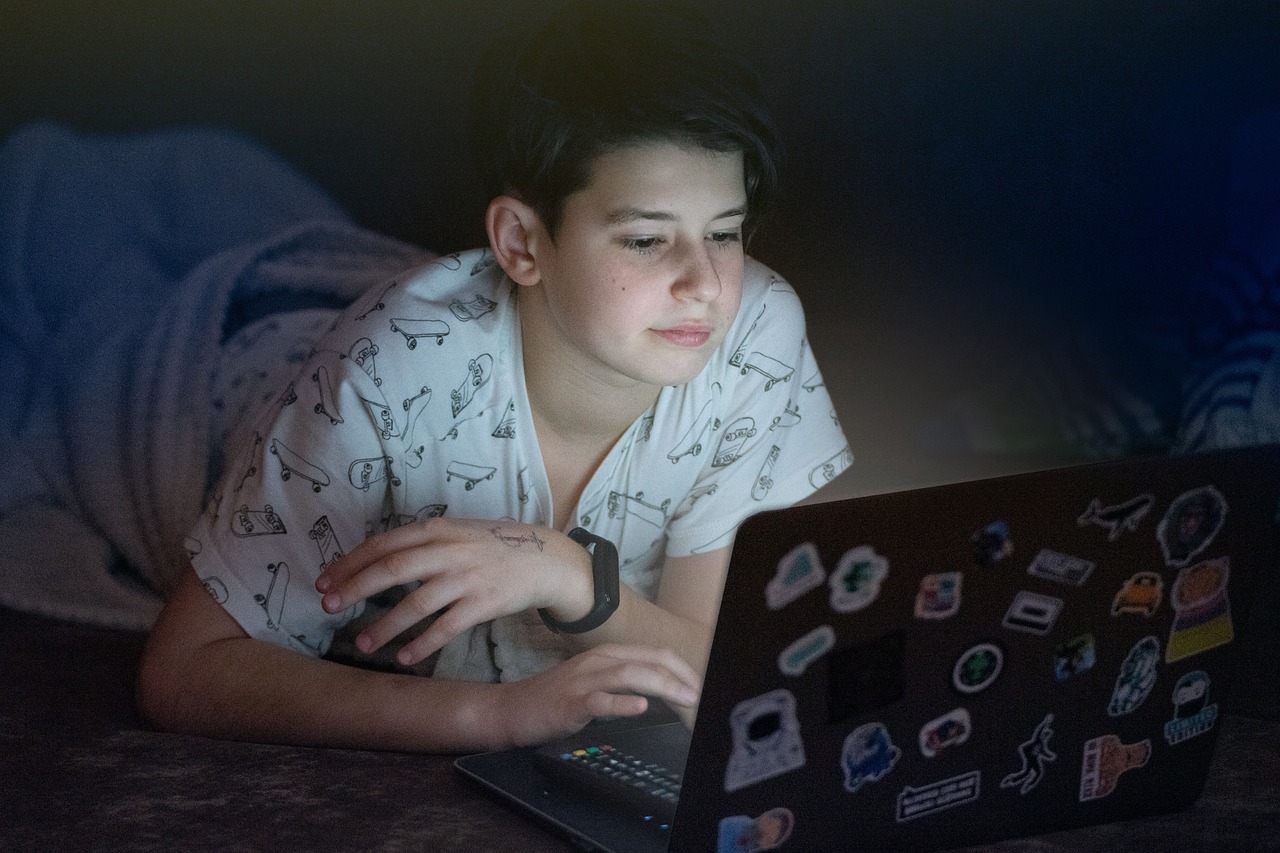

For every story that reaches law enforcement, there are hundreds that never do. Sextortion—where victims are coerced into sharing explicit images or videos and then blackmailed—has exploded in frequency, targeting children and teenagers across the world. In most cases, the victims remain silent. They’re ashamed, afraid, or convinced they’ll be blamed.

This silence makes the crisis uniquely difficult to address. Parents don’t know it’s happening. Schools rarely hear about it. And the financial transactions tied to these crimes—often small but urgent—can flow through the banking system unnoticed.

That’s where financial institutions can play a transformative role. Banks sit at the intersection of trust, communication, and protection. They have the credibility, reach, and technological capability to help families understand and prevent digital exploitation before it leads to financial or emotional devastation.

Why sextortion is a financial issue, not just a social one

At first glance, sextortion may seem far removed from the banking sector—a problem for social platforms or law enforcement. But the connection is far closer than it appears.

Sextortion typically ends with financial coercion. Victims are pressured into sending money through wire transfers, peer-to-peer apps, or even cryptocurrency. Others are convinced to share sensitive personal data, which later enables identity theft and fraud. In some cases, families discover unauthorized withdrawals made in panic, long after the damage is done.

Each of these steps—payment, data sharing, identity compromise—exists squarely within the financial ecosystem. When exploitation becomes a transaction, the bank becomes part of the story, whether it knows it or not.

By broadening their understanding of fraud to include emotionally driven digital coercion, banks can build stronger safeguards against the kinds of manipulative crimes that target young people and their families.

The role of education in digital safety

Technology solutions like identity verification are powerful, but education is where prevention begins. When parents understand the tactics scammers use—and the signs of manipulation—they can intervene early.

Yet awareness remains low. According to recent FBI reports, thousands of sextortion cases now involve minors, many of whom are boys between 14 and 17. These crimes are often orchestrated by organized groups overseas, using fake profiles and AI-generated images to impersonate peers. The scams are deliberate, professional, and devastating.

Parents can’t protect their kids from what they don’t understand. And kids won’t confide in adults they fear will overreact. That’s where banks can make a difference—by using their trusted platforms to bridge the knowledge gap without stigma or judgment.

Banks as educators: a modern form of consumer protection

Financial institutions already excel at educating customers about phishing, card skimming, and identity theft. Extending that same model to digital exploitation—especially sextortion—makes strategic sense.

Consider the reach: banks engage with millions of customers through mobile apps, email campaigns, branch signage, and community programs. Each of those touchpoints is an opportunity to deliver credible, impactful digital safety education.

A short message about “verifying identities before sharing personal content” can plant the seed of caution that prevents a child from engaging with a fake profile. A link to trusted resources can empower a parent to talk with their teen about online risks.

By reframing sextortion as part of the broader fraud landscape, banks can elevate digital literacy across entire communities.

How identity verification helps parents and families

While education raises awareness, identity verification turns awareness into action.

Tools like IDeveryone give parents and organizations the ability to confirm who’s real online—whether it’s a friend request, an account claiming to be a classmate, or an online seller messaging through a social platform.

This kind of real-time validation can prevent a child from ever engaging with a scammer in the first place. It closes the anonymity gap that sextortionists depend on, ensuring that private interactions happen only between verified individuals.

For banks, integrating or promoting such technology aligns perfectly with their consumer protection mission. It demonstrates leadership beyond transactions—helping families safeguard not just their finances, but their digital relationships.

Building trust through transparency

When financial institutions engage in educational outreach about digital safety, they don’t just protect consumers—they strengthen trust.

Customers increasingly expect their banks to be proactive in identifying emerging threats, even those that occur outside traditional financial systems. Addressing topics like sextortion demonstrates empathy and relevance, reinforcing the bank’s role as a protector in a rapidly evolving digital world.

This transparency pays dividends. It deepens customer relationships, reduces fraud-related costs, and positions the bank as a socially responsible leader—especially among parents who view digital safety as a top concern for their families.

From awareness to institutional action

There are tangible, actionable ways banks can begin supporting families in the fight against sextortion:

- Public awareness campaigns: Feature digital safety messages in apps, newsletters, or ATM screens during awareness months.

- Parent-focused education: Partner with schools or community organizations to host webinars on identity-based scams.

- Verification integration: Offer customers access to identity verification tools or recommend third-party services that enhance online safety.

- Early warning systems: Use AI-driven fraud analytics to detect unusual transfers commonly linked to extortion payments.

- Training for staff: Educate bank employees to recognize signs that a customer—especially a young one—may be under coercion or distress.

These steps demonstrate commitment to both financial integrity and human well-being.

Why silence makes prevention essential

One of the most difficult realities of sextortion is that victims rarely speak up. They’re too afraid of exposure or humiliation to ask for help. This silence means institutions can’t rely solely on reactive interventions—they must adopt proactive safeguards.

Identity verification technology allows for that shift. When digital spaces require proof of authenticity, predators lose their most powerful weapon: anonymity.

Financial institutions that support or deploy verification tools contribute directly to preventing sextortion before it reaches the point of crisis. It’s not surveillance—it’s protection through transparency.

A collaborative model for digital protection

No single entity can solve sextortion alone. Progress depends on collaboration between the private sector, public agencies, and technology providers.

Banks can take a leadership role by forming partnerships that combine financial oversight with identity assurance. Imagine financial platforms that automatically verify the authenticity of new payees or flag suspicious accounts linked to social-engineering schemes. These integrations could disrupt the extortion process before money moves.

When institutions like banks align with scam detection providers such as Scamnetic, they create a unified defense—one that protects individuals across both social and financial dimensions.

Why this matters for brand trust and regulatory alignment

Regulators are increasingly emphasizing holistic consumer protection. That includes safeguarding against digital manipulation, privacy breaches, and emotional exploitation that lead to financial harm.

Banks that act early—educating families, investing in verification, and addressing sextortion publicly—demonstrate alignment with these expectations. They also differentiate themselves in a market where trust and transparency are as valuable as interest rates.

This kind of leadership resonates beyond compliance. It shows moral clarity at a time when consumers are looking for institutions that prioritize human safety as much as financial security.

Closing thought: leading the conversation, not reacting to it

The next generation of banking leadership won’t be defined solely by innovation in payments or credit—it will be defined by how institutions protect people from the digital threats that shape their lives.

By helping parents and families understand sextortion, by empowering them with identity verification tools, and by leading the dialogue on digital safety, banks can fulfill a deeper purpose: restoring trust in the digital age.

Every family deserves to feel safe online. Every customer deserves to know their bank is part of that protection. And every institution that steps forward now won’t just be preventing fraud—it will be redefining what consumer protection truly means.

Be the bank that protects what matters most.

Through Scamnetic’s partnership program, you can offer IDEveryone—a trusted verification solution that helps families and parents confirm who’s real online.

Join Scamnetic’s network of partner banks (link to https://scamnetic.com/partner/ )

Continue Learning:

Explore more insights on protecting customers and families from sextortion and digital scams:

- The Hidden Epidemic: How Sextortion Scams Are Targeting Teens Online – Understand the rise of sextortion and why it matters to financial institutions.

- Behind the Screen: How Identity Verification Can Stop Sextortion Before It Starts – Learn how banks can expand consumer protection into the digital world.

- Educating the Front Line: How Banks Can Help Parents Protect Their Kids from Sextortion – Discover strategies to empower parents and families with education and verification tools.

- Prevention Starts with Proof: The Role of Digital Identity Verification in Stopping Sextortion – See how identity verification technology prevents scams before they escalate.