Inside Insurance Fraud: How Scammers Exploit Policies and Identities

Scammers exploit insurance policies through fake claims and identity theft. Discover how insurers can detect fraud in real time and protect policyholders with smarter verification.

Scammers exploit insurance policies through fake claims and identity theft. Discover how insurers can detect fraud in real time and protect policyholders with smarter verification.

Traditional fraud filters miss human manipulation. Discover how AI scam detection is redefining fraud prevention across banking, insurance, and credit industries facing evolving social engineering tactics.

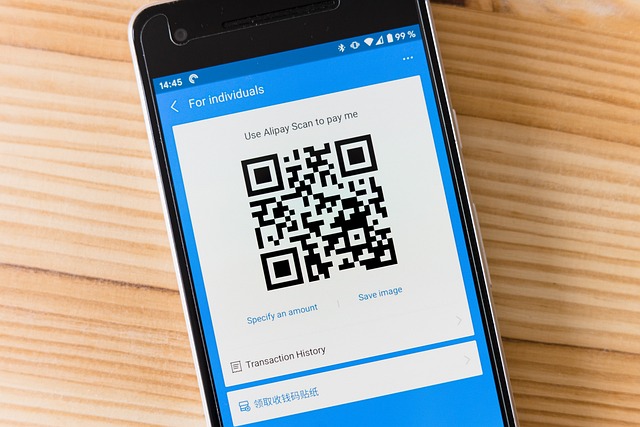

Explore how scammers exploit P2P payment platforms to steal funds and uncover strategies financial institutions can implement to strengthen consumer protection and reduce fraud losses.

Explore why customer authentication fraud prevention needs more than 2FA or biometrics—and how layered protection helps stop scams before they reach your customers.

Explore how APP fraud is accelerating with instant payments like Zelle and FedNow—and what financial institutions can do to reduce risk and safeguard customer trust.

Discover the latest payment fraud trends affecting Zelle, PayPal, and Venmo, and how banks, FIs, and fintechs can enhance security to protect their customers from evolving threats.