For decades, banks have defined fraud prevention in narrow terms—guarding against stolen credit cards, forged checks, and unauthorized transactions. But the threat landscape has shifted dramatically. Today, much of the risk begins long before a transaction occurs.

Modern scams don’t start with compromised credentials—they start with compromised trust. Sextortion, romance scams, synthetic identities, and deepfake impersonations all originate in the same digital gray zone where verification is weak and deception feels effortless.

In this new reality, protecting consumers’ financial data is no longer enough. Banks must evolve into protectors of digital identity itself. Because when identity is the first casualty, financial loss soon follows.

The anatomy of modern fraud: from emotional leverage to financial exploitation

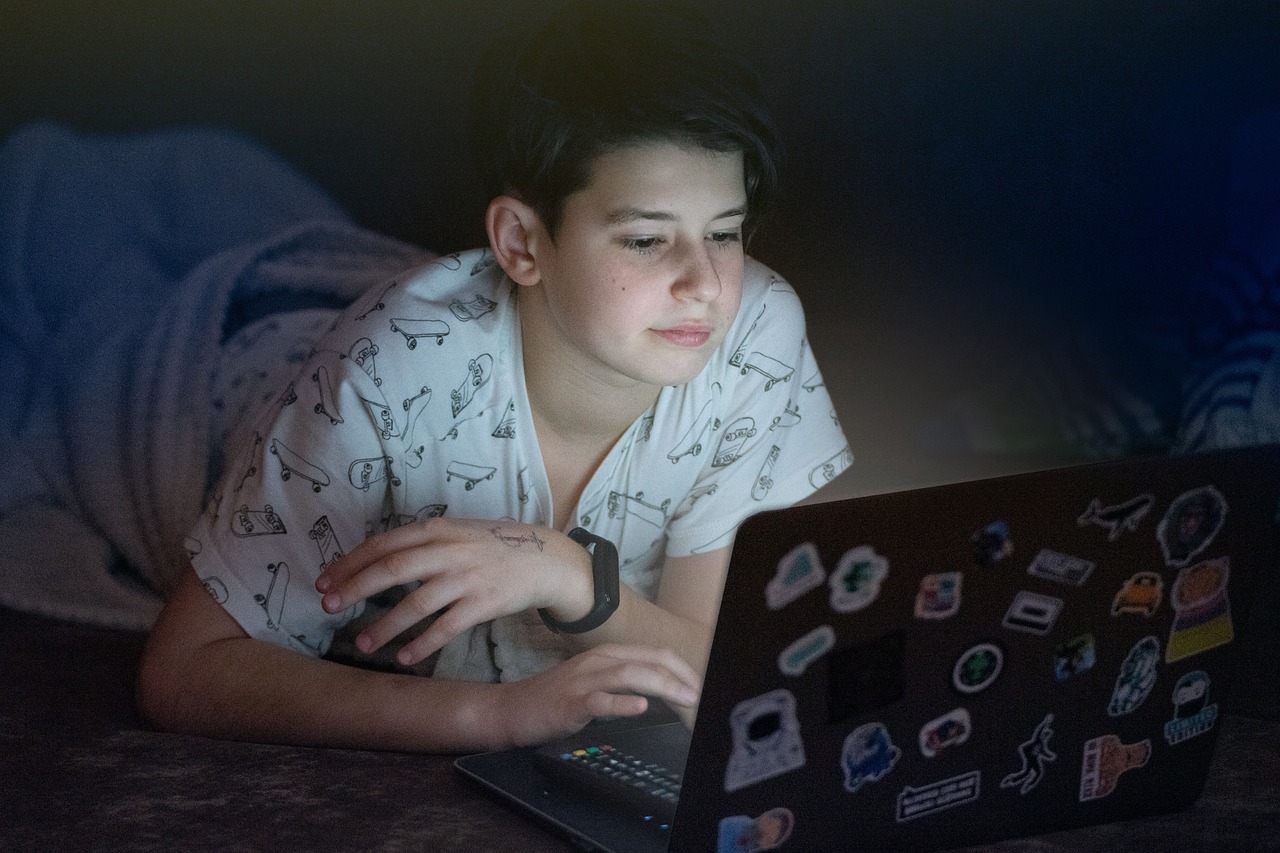

The path from manipulation to monetary loss is not abstract—it’s predictable. Scammers use social engineering to establish emotional control, often through intimate or fear-based coercion. Sextortion is one of the clearest examples: an imposter builds trust online, persuades a young person to share explicit content, and then threatens exposure unless money changes hands.

These payments often flow through traditional financial channels—transfers, digital wallets, or prepaid cards—putting financial institutions squarely in the middle of an exploitation chain. By the time the transaction is flagged, the damage extends far beyond dollars.

It’s not just about detecting fraud after it happens; it’s about preventing digital manipulation before it turns into a financial event.

Why sextortion belongs in the conversation about financial safety

To many banks, sextortion seems like a social issue best left to parents, schools, or tech platforms. But the line between social harm and financial harm is now nonexistent.

When a victim is coerced into making payments, opening new accounts, or taking out loans to pay a blackmailer, the incident becomes a financial crime. It erodes trust not only in online interactions but also in the systems meant to protect consumers.

Regulatory expectations are evolving too. Authorities around the world increasingly view banks as partners in holistic consumer protection—expected to safeguard vulnerable customers from all forms of coercion, not just fraud involving credentials or cards.

By recognizing sextortion as part of the broader ecosystem of financial exploitation, financial institutions can respond more effectively and demonstrate leadership in digital safety.

From KYC to KYX: Know Your Customer—and Everyone They Interact With

Traditional compliance frameworks like KYC (Know Your Customer) were designed for transactional risk, not relational risk. Yet many modern scams hinge on who your customers are communicating with, not just what they’re doing financially.

Enter the concept of KYX—Know Your Counterparty, Know Your Connection, Know Your Context. It’s the recognition that fraud prevention must extend to the social and digital environments surrounding your customers.

That’s where advanced identity verification plays a transformative role. Solutions like IDeveryone enable institutions to verify, in real time, whether the person or entity interacting with their customer is authentic. This capability can be integrated into digital channels, financial apps, and partner ecosystems to expose imposters before money or data changes hands.

Rebuilding digital trust in an age of deception

Digital trust has become one of the most valuable currencies in banking. Consumers expect that the institutions safeguarding their money will also help them navigate the broader risks of the digital economy.

But that trust is fragile. Once a customer experiences a scam—especially one as personal as sextortion—their confidence in all online interactions diminishes. They may hesitate to engage in digital banking, abandon mobile payment tools, or withdraw from online services altogether.

By proactively addressing identity-based scams, banks can reinforce trust and strengthen digital adoption. Identity verification is no longer just a compliance measure—it’s a differentiator that communicates responsibility and care.

The invisible costs of inaction

When financial institutions treat sextortion and similar scams as “outside their domain,” the consequences are not confined to the victims. Reputational risk, regulatory scrutiny, and downstream fraud all increase when deception goes unchecked.

Consider the ripple effects:

- Reputational damage: A customer targeted through a digital channel linked to a bank’s ecosystem may blame the institution for failing to prevent it.

- Increased fraud exposure: Sextortion often overlaps with identity theft and account compromise, introducing new vulnerabilities.

- Compliance pressure: Regulators are beginning to view consumer harm holistically. Failing to act against social-engineering frauds could be interpreted as inadequate consumer protection.

In short, doing nothing costs more than doing something.

How identity verification transforms prevention

The most powerful fraud prevention strategies now begin long before a transaction takes place. They start with verifying the authenticity of the interaction itself.

Digital identity verification enables banks and their partners to:

- Confirm that communications and accounts originate from real, validated users.

- Detect synthetic identities, impersonations, and cloned profiles early.

- Flag suspicious behaviors before financial exposure occurs.

For instance, when integrated across a digital ecosystem, verification can prevent scams like sextortion from spreading through messaging platforms or payment requests. It establishes a foundation of truth—ensuring that consumers interact only with verified, accountable entities.

Scamnetic’s IDeveryone’s technology exemplifies this shift. By validating identity at the point of interaction, it turns digital safety from a reactive function into a proactive one—helping financial institutions intervene before social manipulation evolves into financial loss.

The opportunity for banks: education and empowerment

Financial institutions are uniquely positioned to educate the public. They reach millions of consumers through trusted digital channels and can amplify messages about digital safety that go far beyond fraud alerts.

By promoting awareness of sextortion and other identity-based scams, banks can empower families and customers to take preventive steps—such as using verification tools or avoiding unverified online interactions. This kind of education not only protects customers but also reinforces the bank’s image as a proactive guardian of digital well-being.

In practical terms, this could mean integrating digital-safety education into customer onboarding, newsletters, and app notifications. A short educational prompt—“Verify before you trust”—could prevent irreversible harm.

Collaboration: the future of digital protection

No single entity can combat sextortion alone. The solution lies in coordinated action between financial institutions, social platforms, regulators, and verification providers.

Banks can take the lead by embedding identity verification standards into their partnerships and payment networks—ensuring that any connected platform maintains the same level of accountability. This ecosystem approach transforms digital safety into a shared responsibility, not a siloed initiative.

When banks champion these standards, they don’t just protect their customers—they help raise the bar for the entire digital economy.

Why this matters for the future of banking

The next decade of banking will be defined by how institutions handle digital identity. As AI-generated content, deepfakes, and synthetic profiles proliferate, the ability to distinguish genuine from fake will determine who customers trust with their data, their transactions, and their lives.

Sextortion is one of the most visible and heartbreaking consequences of our identity crisis online. But it’s also a wake-up call—a signal that financial protection must evolve beyond balance sheets and into the fabric of digital interaction itself.

Banks that act now—by integrating identity verification, expanding education, and redefining consumer protection—won’t just prevent loss. They’ll future-proof their trust.

Closing thought: redefining security around humanity

At its core, sextortion isn’t about money. It’s about manipulation, shame, and the abuse of trust. Financial harm is the final act in a sequence of human vulnerability.

For banks, this means reframing security around empathy and authenticity—protecting not just accounts, but the people behind them.

By investing in identity verification and proactive digital protection, financial institutions can transform from silent observers into active defenders of trust. And in doing so, they affirm a simple truth: in the modern digital world, protecting people is protecting finance.

Prevention starts with proof.

Discover how IDEveryone from Scamnetic empowers banks to verify real identities, shut down anonymous scams, and protect customers from digital exploitation.

Explore Scamnetic partnership opportunities (link to https://scamnetic.com/partner/ )

Continue Learning:

Explore more insights on protecting customers and families from sextortion and digital scams:

- The Hidden Epidemic: How Sextortion Scams Are Targeting Teens Online – Understand the rise of sextortion and why it matters to financial institutions.

- Behind the Screen: How Identity Verification Can Stop Sextortion Before It Starts – Learn how banks can expand consumer protection into the digital world.

- Educating the Front Line: How Banks Can Help Parents Protect Their Kids from Sextortion – Discover strategies to empower parents and families with education and verification tools.

- Prevention Starts with Proof: The Role of Digital Identity Verification in Stopping Sextortion – See how identity verification technology prevents scams before they escalate.