Sextortion thrives on anonymity. Digital identity verification cuts through deception by confirming who’s real online—helping protect individuals and institutions from manipulation and financial harm.

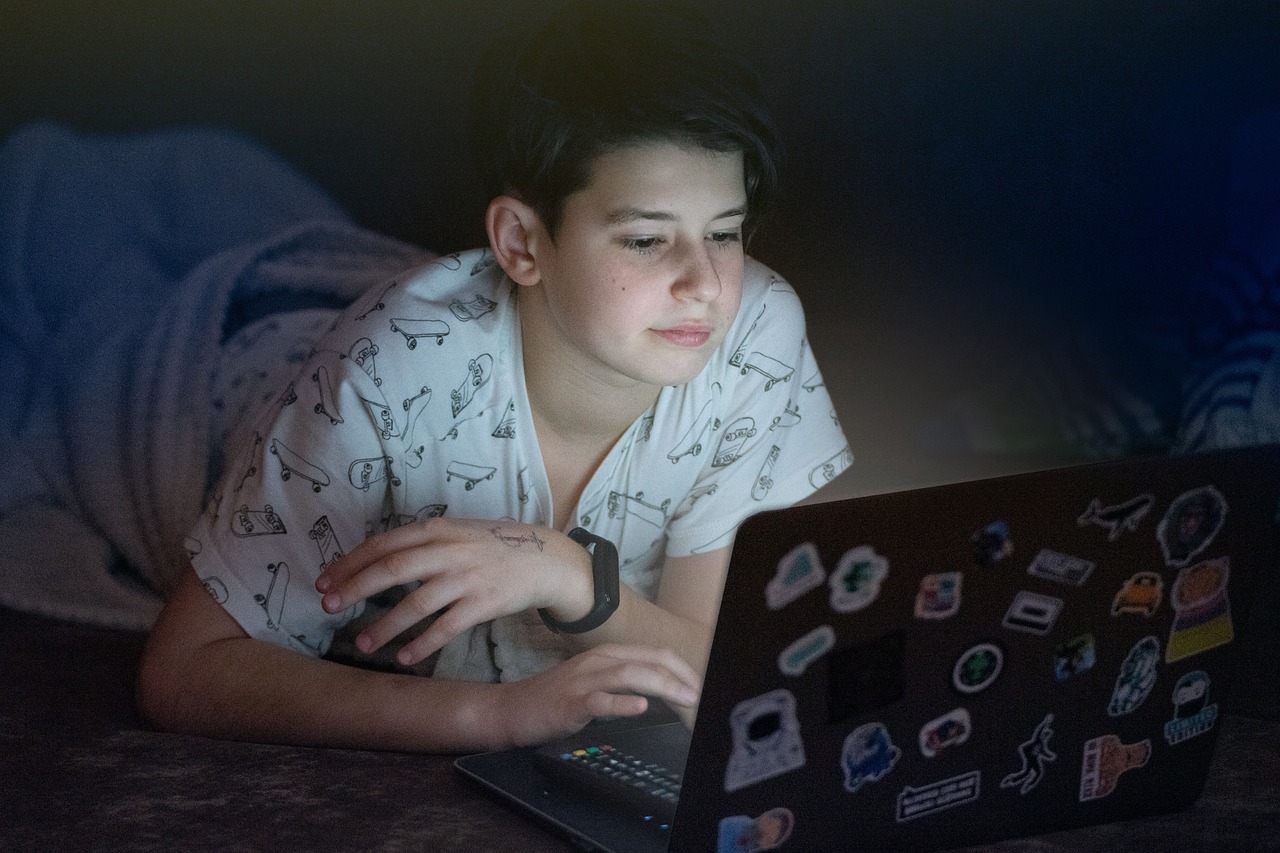

Your digital identity is fluid—and that’s exactly what makes it dangerous. A teenager chatting with what appears to be a peer may actually be speaking to an organized criminal halfway across the world. A parent trying to sell an item on a marketplace may unknowingly engage with a scammer harvesting personal information. The problem isn’t just deception—it’s the absence of reliable proof.

Sextortion, one of the fastest-growing forms of online exploitation, thrives in this gap between appearance and authenticity. Criminals hide behind fabricated personas, fake social media accounts, and increasingly, AI-generated images that make their lies indistinguishable from reality. Victims are manipulated into sharing compromising material, then threatened into silence or coerced into sending money.

The anonymity that fuels this exploitation is the same weakness that identity verification can solve. If the internet had a stronger foundation of verified identity, sextortion would lose its most effective weapon: invisibility.

From anonymous manipulation to authenticated safety

Sextortion is often described as a “social” problem—but at its core, it’s a trust problem. And trust, in digital environments, depends on proof.

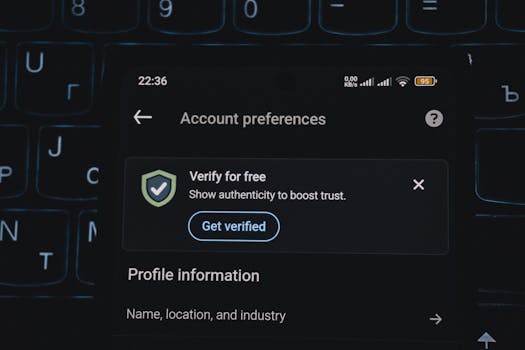

Identity verification provides that proof. By confirming that a person is who they claim to be—through biometric checks, government ID validation, or secure data linkage—it removes the veil that criminals rely on to operate undetected.

In a verified ecosystem:

- Teens could confirm whether a new social contact is real before sharing personal information.

- Parents could trust that a video call request isn’t coming from a fake account.

- Financial institutions could validate that a new account or payment recipient isn’t connected to a coercion ring.

This level of certainty transforms digital safety from reactive defense into proactive prevention.

Why the banking sector must take this personally

While sextortion may seem distant from traditional financial crime, its consequences often end up in the same place—a financial transaction. Victims are pressured to send money to their blackmailers, often through legitimate payment channels.

Banks have both the visibility and the responsibility to intervene. They already monitor for fraud indicators like unusual payment activity or transfers to suspicious accounts. Expanding those models to include the behavioral and contextual patterns of sextortion payments is a natural next step.

But detection alone isn’t enough. Prevention requires addressing the root cause: the ability of bad actors to remain anonymous while manipulating victims. That’s where identity verification technology becomes indispensable—not just as a fraud control, but as a foundation for ethical digital engagement.

By supporting or integrating identity verification systems like IDeveryone, banks can extend their role beyond transaction protection. They can help verify identities across social and communication platforms, preventing scams before they escalate into financial or psychological harm.

How verification changes the dynamics of exploitation

Sextortion follows a predictable path: introduction, grooming, manipulation, and coercion. Each stage depends on the perpetrator maintaining a false identity.

Here’s how identity verification can disrupt that process at every step:

- Introduction: AI-driven verification ensures that new online profiles—whether on social media, messaging platforms, or marketplaces—are tied to real, verified individuals. This eliminates the initial entry point for many predators.

- Grooming: Verification tools embedded in messaging platforms can confirm whether both parties are verified users, alerting individuals if they’re interacting with an unverified or high-risk profile.

- Manipulation: Parents or guardians can use verification systems to check the authenticity of contacts their children are engaging with, turning a moment of doubt into a moment of protection.

- Coercion: When payments are requested, financial institutions equipped with contextual risk models can flag transactions linked to suspicious communication patterns or unverified payees.

With verification embedded across communication, commerce, and banking, the anonymity loop closes—and sextortion loses its primary advantage.

The technology behind digital identity verification

The next generation of verification technology is designed to be simple, privacy-conscious, and effective at scale. IDEveryone combines identity verification and authentication to determine whether a person establishing a new account is legitimate—confirming that the identity information provided is real and that the individual presenting it is truly the owner.

What makes this technology transformative is not just its accuracy, but its ease of use and adaptability. With only a phone number or email address, IDEveryone can verify most identities quickly, across multiple channels, and in just a few simple steps. This frictionless approach ensures that both the customer and the bank experience minimal disruption while maximizing protection.

For financial institutions, integrating IDEveryone means:

- Stronger customer confidence: Customers can trust they’re interacting with verified individuals, reducing the risk of scams and manipulation.

- Broad coverage across channels: Verification can occur at account creation, during digital communication, or before transactions, helping to prevent scams before they escalate.

- Privacy-respecting process: The verification is permissioned and designed to protect personal information, supporting ethical, responsible adoption.

- Empowered consumer education: Banks can position verification as a daily safety habit, encouraging proactive protection without friction.

By adopting or promoting IDEveryone, banks move beyond simply protecting transactions—they become active guardians of digital integrity, helping customers navigate the modern online landscape safely.

Trust as a competitive differentiator

The erosion of trust online has created a vacuum that financial institutions are uniquely positioned to fill. Consumers already associate banks with credibility, privacy, and responsibility. Extending that reputation into digital identity protection is a natural evolution—and a powerful brand differentiator.

Imagine a future where your bank not only prevents fraud on your account but also helps ensure your family’s online interactions are authentic. That’s not a distant vision; it’s an achievable outcome of integrating verified identity into digital ecosystems.

By championing initiatives like IDeveryone, banks can demonstrate leadership that transcends traditional financial services. They become advocates for safer online communities—a stance that builds loyalty, deepens customer trust, and aligns perfectly with emerging regulatory expectations around consumer protection.

Bridging the gap between privacy and protection

One of the most common hesitations around identity verification is the perception that it compromises privacy. But modern verification systems are designed with privacy-first architecture—verifying identity without exposing unnecessary personal information.

For example, a user can confirm they are a verified person without revealing their full name or ID details. This concept, sometimes called selective disclosure, allows individuals to prove authenticity while maintaining control over what they share.

This balance between privacy and safety is critical for adoption. It empowers consumers to participate in verified digital environments without feeling surveilled—turning identity verification into a trust enabler, not an intrusion.

How proactive verification supports regulators and risk teams

Global regulators are beginning to recognize sextortion and similar crimes as part of a broader ecosystem of online exploitation and financial coercion. As such, banks are expected to develop frameworks that identify and mitigate social-engineering risks more holistically.

Verification plays a key role in that evolution. It helps:

- Establish clear digital accountability, linking identities to actions.

- Reduce false positives in fraud detection by distinguishing verified users from malicious actors.

- Support cross-sector collaboration, allowing verified platforms to share risk signals safely and ethically.

Risk management teams can integrate verification data into transaction monitoring systems, adding a layer of human authenticity to behavioral analytics. This combination—identity proof plus machine intelligence—creates a formidable barrier against modern exploitation schemes.

Turning verification into a shared responsibility

Digital identity protection isn’t a service—it’s an ecosystem. To be effective, it requires collaboration between financial institutions, technology providers, educators, and families.

Banks have the credibility. Technology providers like Scamnetic have the tools. Law enforcement and social platforms have the data. Together, they can establish a unified front that makes anonymity-driven crimes like sextortion significantly harder to execute.

By championing shared verification standards and encouraging consumers to adopt identity-based safety practices, banks can catalyze this transformation at scale.

The future: identity as the new firewall

Firewalls once protected networks. Encryption protected data. In the next decade, verified identity will protect people.

When every interaction—from messaging to payments—can be traced to a verified individual, digital spaces become less fertile ground for exploitation. Criminals can no longer hide behind disposable accounts or fake personas. Trust becomes quantifiable again.

For banks, investing in and promoting this vision isn’t just a matter of compliance—it’s a statement of purpose. It says: “We don’t just move money. We protect people.”

Closing thought: proof is protection

Sextortion is one of the clearest examples of how anonymity can be weaponized. It’s a deeply human crisis enabled by a technical gap. But that also means it’s a problem we can solve—if we rebuild digital interaction around identity, not illusion.

Digital identity verification provides the proof modern society has been missing. And prevention always starts with proof.

Banks that champion this shift will not only help stop sextortion before it starts—they’ll redefine what financial stewardship means in a connected world.

Because in the end, trust isn’t built on technology. It’s built on truth. And truth, verified, is the foundation of every safe digital interaction.

[CTA] Build trust through verified identity.

Enhance your digital ecosystem to safeguard customers from identity-based scams and lead the next era of consumer protection.

Partner with Scamnetic to bring IDEveryone to your customers(link to https://scamnetic.com/partner/ )

Continue Learning:

Explore more insights on protecting customers and families from sextortion and digital scams:

- The Hidden Epidemic: How Sextortion Scams Are Targeting Teens Online – Understand the rise of sextortion and why it matters to financial institutions.

- Behind the Screen: How Identity Verification Can Stop Sextortion Before It Starts – Learn how banks can expand consumer protection into the digital world.

- Educating the Front Line: How Banks Can Help Parents Protect Their Kids from Sextortion – Discover strategies to empower parents and families with education and verification tools.

- Prevention Starts with Proof: The Role of Digital Identity Verification in Stopping Sextortion – See how identity verification technology prevents scams before they escalate.