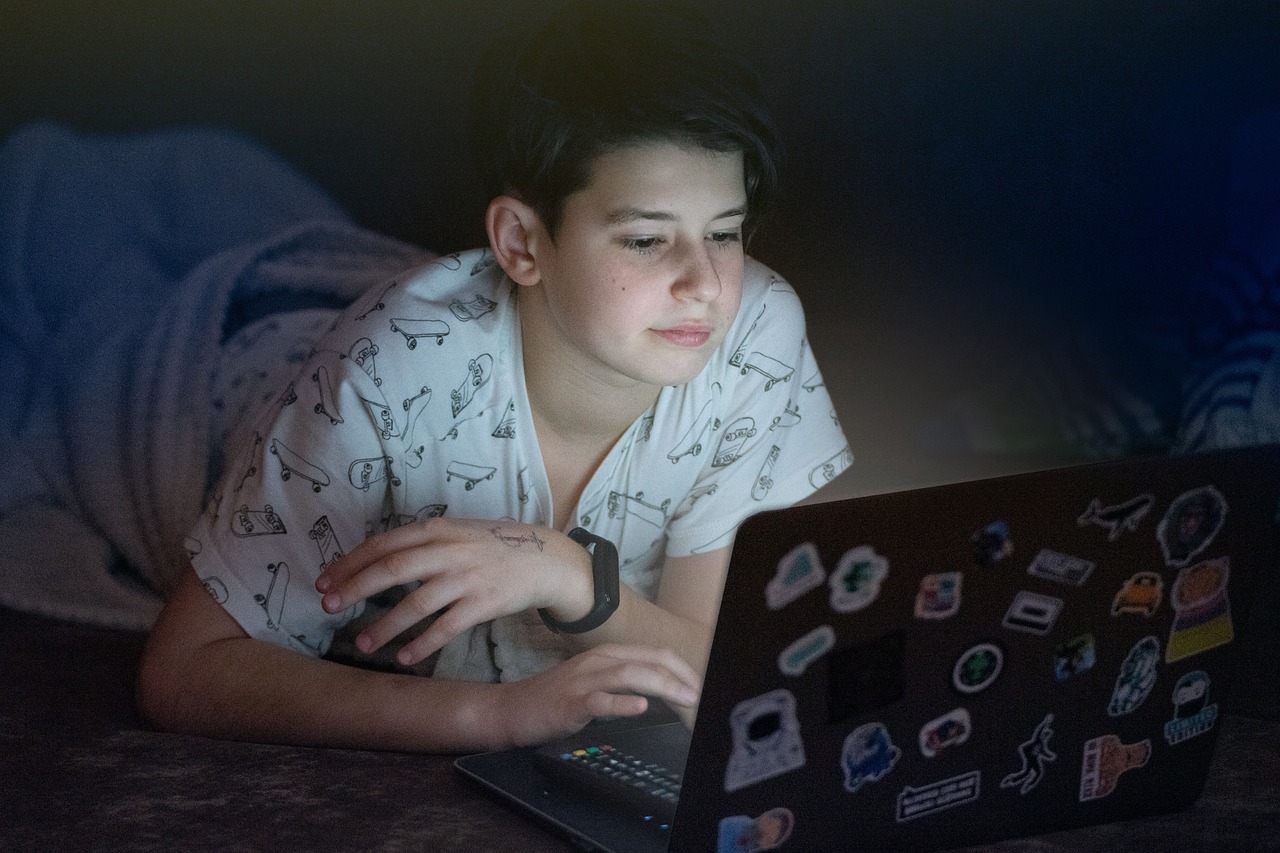

Over the past two years, law enforcement agencies have seen an alarming surge in sextortion—a form of online exploitation where victims, often children or teens, are coerced into sharing explicit photos or videos and then blackmailed for money, more content, or silence. What makes this crisis particularly insidious is how quietly it unfolds. Many victims never speak up, leaving parents unaware and institutions ill-equipped to respond.

The FBI calls sextortion a “global epidemic.” In reality, it’s a digital manipulation crisis powered by a familiar set of forces: fake identities, anonymity, and the erosion of trust online. And while most conversations about sextortion focus on emotional and psychological harm, there’s a broader dimension that financial institutions can no longer afford to ignore. These scams frequently escalate into financial crimes—extortion payments, fraudulent transfers, and identity theft. Protecting consumers now means understanding the entire spectrum of digital threats, from emotional coercion to monetary exploitation.

How sextortion scams unfold

The pattern is heartbreakingly consistent. A scammer poses as a peer—often using stolen photos or AI-generated images—to strike up a friendly or flirtatious exchange on platforms like Instagram, Snapchat, or gaming communities. The interaction feels authentic, disarming, even flattering.

Once trust is established, the scammer encourages the target to share explicit content, then immediately weaponizes it. Threats follow: if the victim doesn’t comply—by sending money or more images—the content will be leaked to family, friends, or employers.

The emotional pressure is devastating. For young people, the fear of humiliation is so intense that many comply. Some take out loans or use their parents’ financial accounts to pay. Others fall into silence, their families unaware until the consequences surface.

In every case, one theme repeats: the scam depends on false identity.

Identity deception: the foundation of modern sextortion

Sextortion doesn’t begin with technology—it begins with impersonation. Scammers build convincing personas using fragments of real social media data, deepfake imagery, or recycled content from hacked accounts. The result is an ecosystem where digital strangers can appear entirely legitimate.

This is where identity verification can become transformative. When individuals, platforms, and even financial institutions use real-time verification to confirm who’s behind an online interaction, deception loses its leverage. A verified identity changes the power dynamic—it gives both individuals and service providers confidence that the person on the other side is genuine.

For banks and fintech platforms, identity verification isn’t just about KYC (Know Your Customer) compliance anymore. It’s about KYP—Know Your Participant—ensuring that the people engaging with consumers, communities, and financial tools are who they claim to be.

Why banks should care: the financial dimension of sextortion

To many, sextortion seems outside the financial sector’s purview. But consider how the scam ends: with payment requests, transfers, or demands for cryptocurrency. Once money changes hands, financial institutions are in the flow—often unknowingly facilitating extortion payments.

That exposure carries both reputational and regulatory risks. Increasingly, regulators and consumer advocates view financial institutions as key players in protecting consumers’ broader digital safety. Just as banks monitor for elder abuse or romance scams, they must now recognize sextortion as part of the continuum of digital coercion that leads to financial harm.

Moreover, the emotional trauma associated with these crimes can erode trust in the entire financial ecosystem. A consumer who feels unprotected in their digital life is less likely to trust digital channels for legitimate transactions.

By extending their protection remit to include digital identity assurance, banks can demonstrate leadership in an area that directly affects public confidence and brand integrity.

The power of proactive prevention

What makes sextortion uniquely difficult to address is that many victims don’t seek help until it’s too late. They’re terrified of being exposed or blamed. Traditional reactive measures—such as fraud alerts or after-the-fact reimbursements—offer little comfort in these cases.

The solution lies in prevention, and prevention begins with proof. When identity verification is embedded at the communication layer—whether in dating apps, messaging platforms, or financial onboarding—it cuts off the scammer’s ability to impersonate.

For banks, this proactive approach aligns with a broader industry shift toward digital trust. By partnering with identity verification providers like Scamnetic, financial institutions can help create ecosystems where verified interactions become the norm, not the exception. These measures don’t just reduce fraud; they help safeguard the next generation of consumers before exploitation occurs.

Building digital resilience through collaboration

Addressing sextortion requires more than technology. It demands coordination among platforms, educators, law enforcement, and the financial sector. Banks are in a powerful position to catalyze that collaboration.

Imagine a scenario where a parent, opening their banking app, sees educational content about digital scams and links to trusted tools that help families verify online identities. That small act of awareness could prevent a devastating incident.

By using their trusted voice and customer reach, banks can normalize conversations about sextortion without stigma—and promote the message that digital safety is a shared responsibility.

Reframing what consumer protection means

Consumer protection once meant keeping thieves out of accounts. Today, it means keeping predators out of lives. The threats have evolved from stolen credit cards to stolen trust, and financial institutions that recognize this shift early will lead the next generation of digital safety innovation.

Sextortion is more than a cybersecurity issue—it’s a test of how we define responsibility in a connected world. When banks, technology providers, and verification platforms unite around the shared goal of authentic digital identity, they do more than prevent fraud. They protect human dignity.

Closing thought: proof as protection

Every message, every interaction, every transaction online depends on trust. Sextortion thrives where that trust is unverified.

By embracing identity verification as a core element of consumer protection, financial institutions can extend their reach beyond financial safety into digital well-being. For a generation growing up online, that protection isn’t optional—it’s essential.

[Protect your customers before the threat begins.

Partner with Scamnetic to integrate IDEveryone, the digital identity verification platform that stops social-engineering scams—like sextortion—before they escalate.

Learn more about becoming a Scamnetic partner. (link to https://scamnetic.com/partner/ )

Continue Learning:

Explore more insights on protecting customers and families from sextortion and digital scams:

- The Hidden Epidemic: How Sextortion Scams Are Targeting Teens Online – Understand the rise of sextortion and why it matters to financial institutions.

- Behind the Screen: How Identity Verification Can Stop Sextortion Before It Starts – Learn how banks can expand consumer protection into the digital world.

- Educating the Front Line: How Banks Can Help Parents Protect Their Kids from Sextortion – Discover strategies to empower parents and families with education and verification tools.

- Prevention Starts with Proof: The Role of Digital Identity Verification in Stopping Sextortion – See how identity verification technology prevents scams before they escalate.